Job Ready - Short Courses

This training is fee-free and fully subsidised by the NSW Government

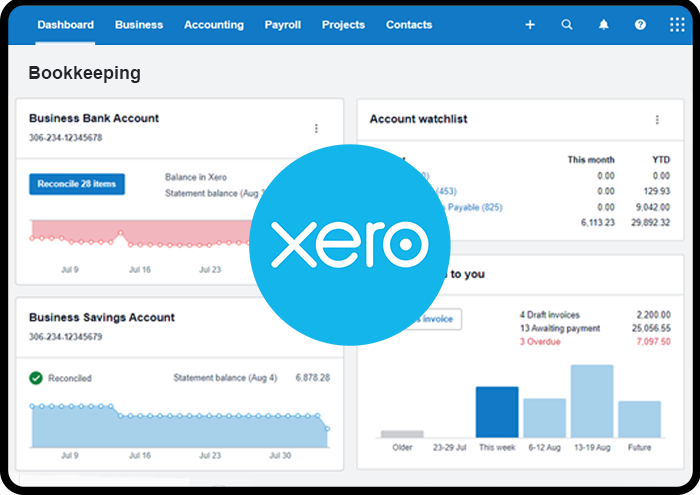

Kick-start your career in the bookkeeping and accounting industry or add to your business expertise as you gain the skills to use Xero accounting software. Learn how to process and analyse business transactions or learn how to establish and process a basic payroll for small to medium businesses.

All subjects are Nationally accredited and are part of the Certificate IV in Accounting and Bookkeeping.

Bookkeeping with Xero

-

16/10/2023 (Closed)

Duration: 8 weeks

Frequency: 3 days/week

-

FNSACC321 Process financial transactions and extract interim reports

FNSACC322 Administer subsidiary accounts and ledgers

FNSACC323 Perform financial calculations

FNSACC426 Set up and operate a computerised accounting system

-

*Fee Free: This training is subsidised by the NSW Government.

-

Teacher led, Online Virtual Classroom

Payroll with Xero

-

Enrolments closed

Start date: 29/04/2024

Duration: 4 weeks

Frequency: 4 days/week

-

BSBTEC301 - Design and produce business documents

BSBTEC302 - Design and produce spreadsheets

BSBHRM416 - Process payroll

-

*Fee Free: This training is subsidised by the NSW Government.

-

Teacher led, Online Virtual Classroom

The following workshop is also included in our Job Ready Short Courses:

Employability Skills (Resume Writing, Cover Letter & LinkedIn Setup)

Study Pathways

FNS40222 - Certificate IV in Accounting and Bookkeeping

Once you have completed Bookkeeping with Xero or Payroll with Xero, you will receive direct credits for FNS40222 - Certificate IV in Accounting and Bookkeeping. This qualification reflects the job roles of workers in the accounting industry, including BAS Agents and contract bookkeepers; and of those employees performing bookkeeping tasks for organisations in a range of industries.

It includes preparing and lodging business and instalment activity statements, and providing advice or dealing with the Commissioner on behalf of a taxpayer in relation to activity statements.

-

Term 2, 2024 (closed)

Duration: 12 months

Frequency: 2 days/week

-

BSBTEC302 Design and produce spreadsheets

FNSACC321 Process financial transactions and extract interim reports

FNSACC322 Administer subsidiary accounts and ledgers

FNSACC412 Prepare operational budgets

FNSACC414 Prepare financial statements for non-reporting entities

FNSACC418 Work effectively in the accounting and bookkeeping industry

FNSACC421 Prepare financial reports

FNSACC426 Set up and operate computerised accounting systems

FNSTPB411 Complete business activity and instalment activity statements

FNSTPB412 Establish and maintain payroll systems

BSBTEC301 Design and produce business documents

BSBTEC402 Design and produce complex spreadsheets

FNSACC323 Perform financial calculations

-

Completion of Short Course (Bookkeeping or Payroll) + $1,980

-

Self Paced, blended with Online Virtual Classroom

BSB40120 - Certificate IV in Business

Ready to jump into the Business World but not quite sure where your passion lies? Or perhaps you're running a start up company but desire the practical skills and experience that will enable you to fast-track to success. Our hands on approach to learning from our experienced teachers will get you exactly where you need to be!

Once you have completed Bookkeeping with Xero or Payroll with Xero, you will receive direct credits for BSB40120 - Certificate IV in Business.

-

Term 3, 2024

Duration: 12 months

Frequency: 2 days/week

-

BSBCRT411 Apply critical thinking to work practices

BSBTEC404 Use digital technologies to collaborate in a work environment

BSBTWK401 Build and maintain business relationships

BSBWHS411 Implement and monitor WHS policies, procedures and programs

BSBWRT411 Write complex documents

BSBXCM401 Apply communication strategies in the workplace

BSBPEF402 Develop personal work priorities

BSBPEF403 Lead personal development

BSBFIN301 Process financial transactions

BSBHRM416 Process payroll

BSBTEC302 Design and produce spreadsheets

BSBTEC301 Design and produce business documents

-

Completion Short Course

(Business Admin Essentials or Bookkeeping or Payroll) + $1,980 -

Self Paced, blended with Online Virtual Classroom

How is the course delivered?

Classroom

Williams Business College is located

on Level 2, 222 Pitt St. Sydney.

Just a short walk from Town Hall Station.

Teacher led, Online Virtual Classroom

If you prefer a classroom learning environment but require the flexibility of online learning, we highly recommend the Online Virtual Classroom option.

Self Paced, blended with Online Virtual Classroom

If you’re self motivated and like to set your own schedule, then a blend of Self Paced with Online Virtual Classroom could be the right option for you.

Are there any entry requirements for this course?

For entry into our this course, you need to:

Demonstrate that you have the Language, Literacy, Numeracy and Digital Skills to be able to satisfactorily complete the training program applied for; and

Have access to a home computer with a reliable internet connection and webcam.

Potential Careers

Payroll Officer

Accounts Officer

Business manager

Bookkeeper

Accounts Assistant

Business owner

Accounts Receivable

Accounts Payable

Assistant manager

Certification badges show that an advisor has completed a programme of courses that provides them with the knowledge and skills to serve clients proficiently and effectively. To maintain their certification, advisors must have industry currency and continue to professionally develop their skills and knowledge.

Fikri Thalib is a Registered BAS Agent and a Xero Certified Advisor, he has over 10 years of experience in the accounting and finance industry. In the last decade, he has owned and financially managed different businesses. One of these being Open-Book Business Solutions, which provides bookkeeping and accounting services for small to medium businesses.

HEAD LECTURER - FIKRI THALIB

Recognition of Prior Learning or RPL?

As a candidate, you may already have the necessary skills or knowledge required to achieve some or all parts of the qualification. This may be because you:

Are already effectively working in the area; and/or

Have completed appropriate training; and/or

Have gained relevant experience in a similar or different industry. For example, you may have gained valuable planning skills from working in the retail industry, such as project management skills, which are also relevant to this industry; and/or

Have had other life experiences where relevant knowledge and skills were covered. For example, you may have experience in leading others in a sporting club that aligns with teamwork units of competency in this qualification.

If you fit any of these situations you can apply for Recognition of Prior Learning (RPL). This means that you may be assessed as competent without having to do the training or parts of it.

Call our office today to discuss your eligibility.