Accounting and

Bookkeeping

Job Ready - Short Courses

Kick-start your career in the bookkeeping and accounting industry or add to your business expertise as you gain the skills to use Xero accounting software. Learn how to process and analyse business transactions or learn how to establish and process a basic payroll for small to medium businesses.

All subjects are Nationally accredited and are part of the Certificate IV in Accounting and Bookkeeping.

Payroll with Xero

Add to your business expertise as you gain the skills to use Microsoft and Xero accounting software to produce business documents and establish and process payroll for a small to medium business.

-

Date: Pending

Duration: 8 weeks

Frequency: 2 days/week

-

BSBTEC301 - Design and produce business documents

BSBTEC302 - Design and produce spreadsheets

BSBHRM416 - Process payroll

-

*This training is fee-free and fully subsidised by the NSW Government.

-

Teacher led, Online Virtual Classroom

(if you have previous qualifications or industry experience, you may be able to enrol in self paced)

The following employment support is also included:

Cover letter & resume writing

Mock interview practice

LinkedIn setup

Job placement support

Bookkeeping Essentials

This course covers the core skills and knowledge needed to manage financial records and support business operations confidently.

-

Start date: Anytime

Duration: 6 months

-

FNSACC321 Process financial transactions and extract interim reports

FNSACC322 Administer subsidiary accounts and ledgers

FNSACC323 Perform financial calculations

FNSACC421 Prepare financial reports

FNSACC418 Work effectively in the accounting and bookkeeping industry

FNSACC426 Set up and operate computerised accounting systems

-

Full price: $1,495

-

Self Paced with online support.

BAS Agent Skill Set (FNSSS00004)

This skill set is designed for persons who are seeking registration as a business activity statement (BAS) agent with the Tax Practitioners Board (TPB).

-

Start date: Anytime

Duration: 3 months

-

FNSTPB411 Complete business activity and instalment activity statements

FNSTPB412 Establish and maintain payroll systems

-

$795.00

-

Self paced with online support.

Please note: As per TPB requirements, one assessment for each unit will be undertaken under independent supervision.

Accounting Principles Skill Set (FNSSS00014)

Once you have completed our Bookkeeping Essentials and our BAS Agent Skill Set, you will be awarded the Accounting Principles Skill Set (FNSSS00014) Certificate… Free of Charge 😊🧑🎓🎉

Certificate IV Upgrade

This course is for students that have completed our Bookkeeping Essentials and BAS Agent Skill Set, and would like to receive direct credits for the FNS40222 Certificate IV in Accounting and Bookkeeping qualification.

Bookkeeping Essentials + BAS Agent Skill Set + Certificate IV Upgrade = FNS40222 Certificate IV in Accounting and Bookkeeping

-

Start date: Anytime

Duration: 6 months

-

FNSACC414 Prepare financial statements for non-reporting entities

FNSACC412 Prepare operational budgets

BSBTEC302 Design and produce spreadsheets

BSBTEC301 Design and produce business documents

BSBTEC402 Design and produce complex spreadsheets

-

$795

-

Self paced with online support.

FNS40222 Certificate IV in Accounting and Bookkeeping

Once you have completed our Bookkeeping Essentials course, the BAS Agent Skill Set and the Certificate IV Upgrade, you will be awarded the Certificate IV in Accounting and Bookkeeping qualification.

This qualification reflects the job roles of workers in the accounting industry, including BAS Agents and contract bookkeepers; and of those employees performing bookkeeping tasks for organisations in a range of industries.

It includes preparing and lodging business and instalment activity statements, and providing advice or dealing with the Commissioner on behalf of a taxpayer in relation to activity statements.

Potential Careers

Payroll Officer

Accounts Officer

Business manager

Accounts Receivable

Accounts Payable

Assistant manager

Bookkeeper

Accounts Assistant

Business owner

Head Lecturer - Fikri Thalib

Certification badges show that an advisor has completed a programme of courses that provides them with the knowledge and skills to serve clients proficiently and effectively. To maintain their certification, advisors must have industry currency and continue to professionally develop their skills and knowledge.

Fikri Thalib is a Registered BAS Agent and a Xero Certified Advisor, he has over 10 years of experience in the accounting and finance industry. In the last decade, he has owned and financially managed different businesses. One of these being Open-Book Business Solutions, which provides bookkeeping and accounting services for small to medium businesses.

Head Lecturer - Fikri Thalib

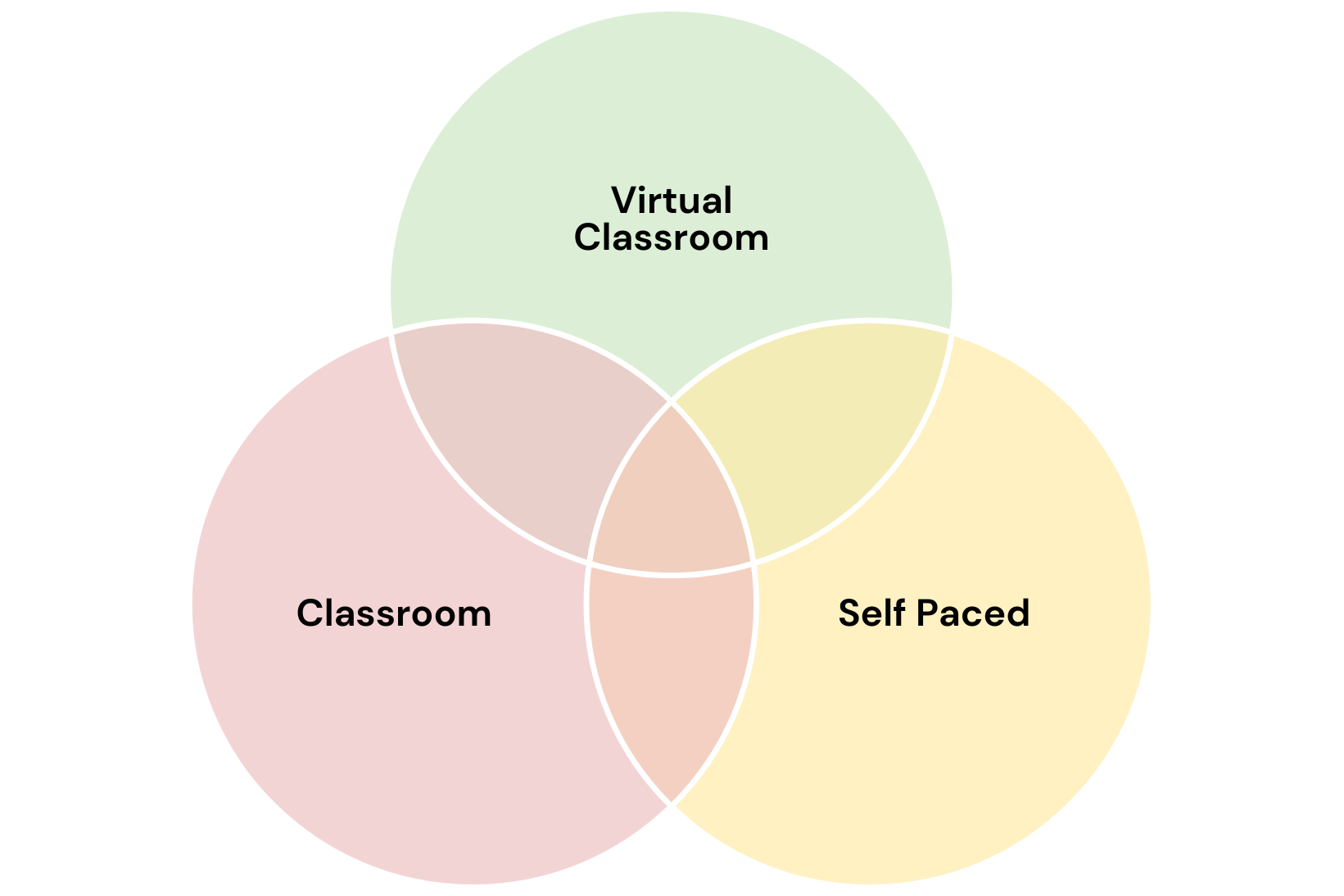

How are our courses delivered?

-

Classroom (Face to face)

Williams Business College is located on Level 2, 222 Pitt St. Sydney.

Just a short walk from Town Hall or St James Train Station.

-

Teacher led, Online Virtual Classroom.

If you prefer a classroom learning environment but require the flexibility of online learning, we highly recommend the Online Virtual Classroom option.

-

Self Paced with online support.

If you’re self motivated and like to set your own schedule, then a blend of Online Virtual Classroom with Self Paced could be the right option for you.

-

Blended methods of delivery.

Our blended courses combine delivery methods that are carefully considered, and selected intentionally to support learning outcomes.

Are there any entry requirements for this course?

Demonstrate that you have the Language, Literacy, Numeracy and Digital Skills to be able to satisfactorily complete the training program applied for; and

Have access to a home computer with a reliable internet connection and webcam.

For entry into this course, you need to:

Learning or RPL?

As a candidate, you may already have the necessary skills or knowledge required to achieve some or all parts of the qualification. This may be because you:

Are already effectively working in the area; and/or

Have completed appropriate training; and/or

Have gained relevant experience in a similar or different industry. For example, you may have gained valuable planning skills from working in the retail industry, such as project management skills, which are also relevant to this industry; and/or

Have had other life experiences where relevant knowledge and skills were covered. For example, you may have experience in leading others in a sporting club that aligns with teamwork units of competency in this qualification.

If you fit any of these situations you can apply for Recognition of Prior Learning (RPL). This means that you may be assessed as competent without having to do the training or parts of it.

Call our office today to discuss your eligibility.